You didn’t get the job. Worse yet, you got scammed. Because the opening was never real in the first place. It was a job scam, through and through.

We’ve covered job scams for some time here in our blogs. And as it is with many other sorts of scams, AI tools have made it easier for scammers to pull them off.

It looks something like this:

- Thousands of phony job listings are written by AI chatbots.

- Bogus social media profiles, many also created with AI, posing as recruiters.

- Scam texts and emails featuring non-existent job offers.

- And all kinds of fake interview loops are held entirely online, all masking the identity of the scammers behind them.

And the number of these attacks? They’re on the rise.

In the Federal Trade Commission’s (FTC) report earlier this year, it called out $491 million in reported losses due to job scams in 2023. Compared to the $367 million reported the year prior, that marked more than a 25% increase in losses. Overall, the median loss per victim was just above $2,000 each.

This aligns with further figures from the Identity Theft Resource Center (ITRC), which also saw a bump in online job scams. Comparing 2023 with 2022, the ITRC reported a 118% jump in reported scams.

As with all such figures, these only capture reported cases of job scams. Not everyone files a complaint with the FTC, law enforcement, or other agencies. Those figures are thus likely higher.

What are social media and job-hunting platforms doing about job scams?

Social media platforms have several mechanisms in place to identify and delete the phony profiles that scammers use for these attacks. In 2023, LinkedIn reported the removal of 86.8 million fake accounts over the year.[i] More than 90% were caught at registration and the remainder were caught through manual investigations. Overall, 99.6% of fake accounts were eliminated before a LinkedIn member reported it.

Likewise, Facebook has its own measures in place. Across 2023, they removed more than 2.6 billion fake accounts.[ii] Automated and other internal safeguards caught roughly 99% before users reported them. As for their latest figures, Facebook says it caught 99.7% of fake accounts before users reported them.

However, other platforms prove problematic. That’s simply due to their nature. As such, many job scam offers come by way of a Telegram message. Here, “recruiters” have a particularly enticing offer, yet say that they only communicate over Telegram. With that, job seekers have no real way of knowing who’s truly on the other end of the conversation.

Needless to say, that’s much the same problem people have with job scams that find them via text.

With that, scammers still find their way through carefully established defenses. And others stick to platforms and technologies that provide them with cover. For them, it’s a numbers game. They create high volumes of scam profiles, posts, and messages — now made easier with AI tools — and reel in their victims who fall for their lures. As the FTC’s data shows, just a handful of victims can reap thousands in return.

As job scams rise, here’s what to look out for

The people behind job scams want the same old things. They want your money, and they want your personal info for identity theft. In some cases, they want you to launder money or pass along bad checks, all under the guise of signing up for onboard training and materials.

Those are just a few of the signs. Here are several other red flags to look for:

They ask for your Social Security or tax ID number.

In the hands of a scammer, your SSN or tax ID is the primary key to your identity. With it, they can open up bank cards, and lines of credit, apply for insurance benefits, collect benefits and tax returns, or even commit crimes, all in your name. Needless to say, scammers will ask for it, perhaps under the guise of a background check or for payroll purposes. The only time you should provide your SSN or tax ID is when you know that you have accepted a legitimate job with a legitimate company, and through a secure document signing service, never via email, text, or over the phone.

They want your banking information.

Another trick scammers rely on is asking for bank account information so that they can wire a payment to you. As with the SSN above, closely guard this info and treat it in the same way. Don’t give it out unless you actually have a legitimate job with a legitimate company.

They want you to pay before you get paid.

Some scammers will take a different route. They’ll promise employment, but first, you’ll need to pay them for training, onboarding, or equipment before you can start work. Legitimate companies won’t make these kinds of requests.

And look at the offer itself — more red flags to look for.

Aside from the types of info they ask for, the way they ask for your info offers other clues that you might be mixed up in a scam. Look out for the following as well:

1) The offer is big on promises but short on details.

You can sniff out many online scams with the “too good to be true” test. High pay, low hours, and even offers of things like a laptop and other perks might be the signs of a scam. When pressed for details, some scammers offer an answer full of holes or no reply at all.

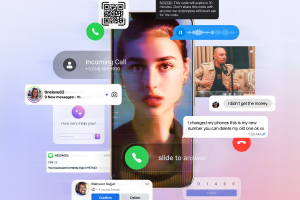

2) They communicate only through email or chat.

Job scammers hide behind their screens. They use the anonymity of the internet to their advantage, so they won’t agree to a video chat or call, which are common nowadays. That’s a possible sign. Yet AI tools have changed the game here somewhat. Sophisticated scammers can create real-time deepfakes that overlay faces and voices over a scammer’s face and voice in video calls.

3) Things move too quickly.

Scammers love to keep their scams moving along at a good clip. They want to cash in quickly and move on to their next victim. Pay close attention if the recruiter starts asking for personal info almost right away. Or if they start asking for money or any dealings with money. It might be a scam.

Further ways you can protect yourself from job scams.

Do a little background check. Any time an employer or recruiter comes along, check out their company or employment agency online. It’s just the same as you would if you were prepping for an interview. Look at their history, what they do, how long they’ve been doing it, and where they have locations. Online reviews can help, as can a quick search online with the company’s name followed by “scam.”

You can also dig a little deeper than that.

In the U.S., the Better Business Bureau (BBB) offers a searchable listing of businesses. That includes a brief profile, a rating, and even a list of complaints (and company responses) waged against them. Spending some time here can help sniff out trouble.

Internationally, you can turn to organizations like S&P Global Ratings and the Dun and Bradstreet Corporation. They can provide detailed background info, yet they might require signing up for an account.

Yet be on the lookout for imposters. Many job scammers will pose as recruiters at legitimate companies. They’ll use the logos and digital letterhead of real organizations and generally do what they can to convince you that they, and their offer, are real.

In these cases, look for the warning signs mentioned above. Follow up by visiting the website of the company in question. See if the job is listed there. Also, see if the contact info on the site matches up with the contact info the “recruiter” used to reach you. If they differ, you’re likely looking at a scam.

Lastly, protect yourself and your devices

Given the way we rely so heavily on the internet to get things done and simply enjoy our day, comprehensive online protection software that looks out for your identity, privacy, and devices is a must. Specific to job scams, it can help you in several ways, these being just a few:

- Scammers still use links to malicious sites to trick people into providing their personal information. Web protection, included in our plans, can steer you clear of those links.

- And scammers love lacing texts with links to suspicious sites and other places that can steal personal info. Our Text Scam Detector can block those links and prevent you from clicking on them. AI technology automatically detects scams by scanning URLs in your text messages. If you accidentally click a bad link, it’ll block a risky site.

- Scammers have to reach you one way or another. Many get that contact info from data broker sites. Fueled by thousands of data points on billions of people, they can harvest your contact info, along with other personal info for a highly tailored attack. McAfee’s Personal Data Cleanup scans some of the riskiest data broker sites, shows you which ones are selling your personal info, and, depending on your plan, can help you remove it.

[i] https://about.linkedin.com/transparency/community-report#fake-accounts-2023-jul-dec

[ii] https://transparency.meta.com/reports/community-standards-enforcement/fake-accounts/facebook/#content-actioned